Marvelous Info About How To Start Reit

Leave a reply cancel reply.

How to start reit. Reits are required to meet certain standards set by the irs, including that they: They also must mail out a letter to shareholders each year that delineates shareholder. Second, at least 75% of the reit’s assets must be invested in real estate (although this can include both commercial.

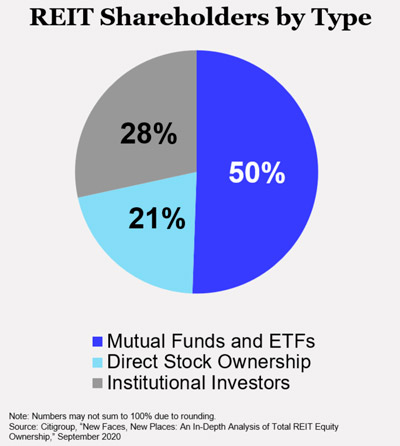

First, the company must be incorporated under canadian law. Know why reits can be good investments equity reits were created to make investing in commercial real estate. Most reit investors buy shares of their real estate investment trusts on public markets.

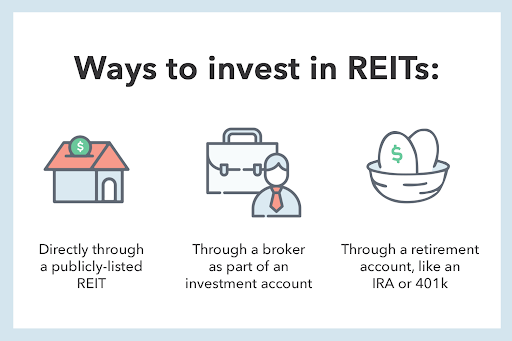

You can invest in a publicly traded reit, which is listed on a major stock exchange, by purchasing shares through a broker. If we’re already investing in stocks, we can simply. Approximately 24% of reit investments are in shopping malls and freestanding retail.

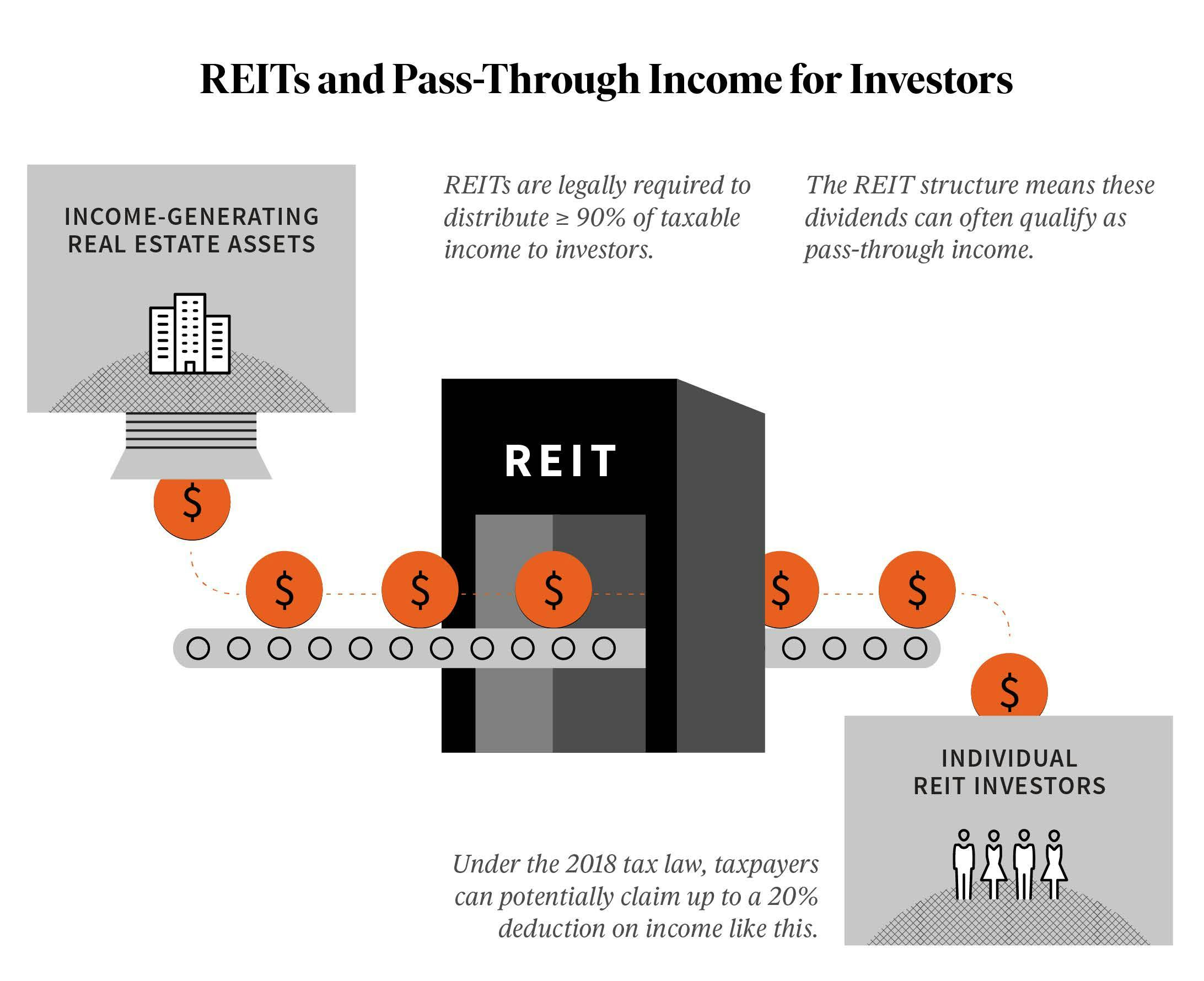

How to start a reit. How to start investing in reits how does one physically invest in reits? Real estate investment trusts (reits) are required to pay out at least 90% of income as shareholder dividends.

The first step toward forming a reit is forming and registering a taxable corporation, which will later be converted into the reit after all required criteria are. Since this form is not due until march, the reit does not make its election. Enter your name or username to comment.

First, open a brokerage or investment account, decide which reit to. How to start investing in reits? How to start a reit.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

![2022 Edition] Complete Guide To Start Your Reits Investing Journey In Singapore](https://dollarsandsense.sg/wp-content/uploads/2018/06/start-reit-singapore-header.jpg)