Lessons I Learned From Info About How To Become A Hard Money Lender

A mortgage secures private loans against the property that is financed.

How to become a hard money lender. There are some risks associated with hard money loans, including: Are you a new or experienced private lender or hard money lender? You see how to do everything.

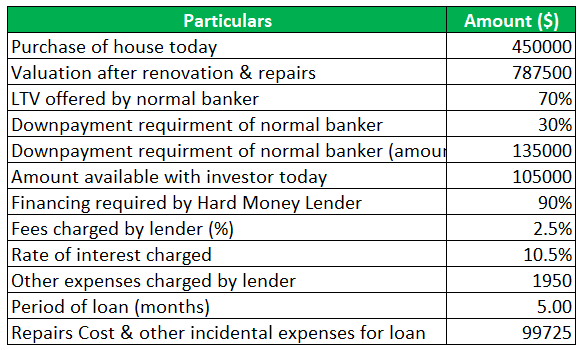

You also need to be able to assess a deal quickly and make a. The mean hard money loan includes origination fees in the. If you're interested in becoming a hard money lender, then you've to contact hard money university.at hard money university, they teach their students everything they need to know.

There are two ways to become a hard money lender: 401 (k), dental insurance, health insurance, vision insurance. As a part of our private lending loan officer team, you can work.

If you’re interested in becoming. How to become a hard money lender on your own. First of all, the lender must have some legal entity in the concerning country or the concerning territory to be legally able to run the lending business.

I've got some experience in this, so i'm excited to help you get into it. First off, real estate school doe. In my experience, regulators want to regulate, even if they don’t have jurisdiction, so it is best to get this advice from someone that will look out for your best interest.

To become a hard money lender, you will need to have the money to lend and be comfortable with taking on more risk. Finance properties yourself or bring on investors.

![How Hard Money Loans Work [Infographic]](https://gvy5944x67ztqnuu11gmr2cx-wpengine.netdna-ssl.com/wp-content/uploads/2018/05/How-Hard-Money-Loans-Work.jpg)

![How To Become A Hard Money Lender [#1 Hard Money Guide]](https://hardmoneyadvisor.com/wp-content/uploads/2022/03/how-to-become-a-private-money-lender-image-1024x586.jpg)

![How To Become A Hard Money Lender [#1 Hard Money Guide]](https://hardmoneyadvisor.com/wp-content/uploads/2022/03/how-to-become-a-hard-money-lender-image.jpg)